Amongst those common characteristics which have implications for the manner in which investors approach investment are

A tendency to stick with existing beliefs – Beliefs tend to be based on the degree to which information is available – media mentions, rumour, chat. We tend to overvalue data which supports our beliefs and underweight contrary information.

Conservatism – Investors tend to be fearful of the unknown or the new. They prefer the familiar to the unfamiliar. They seek protection in the herd.

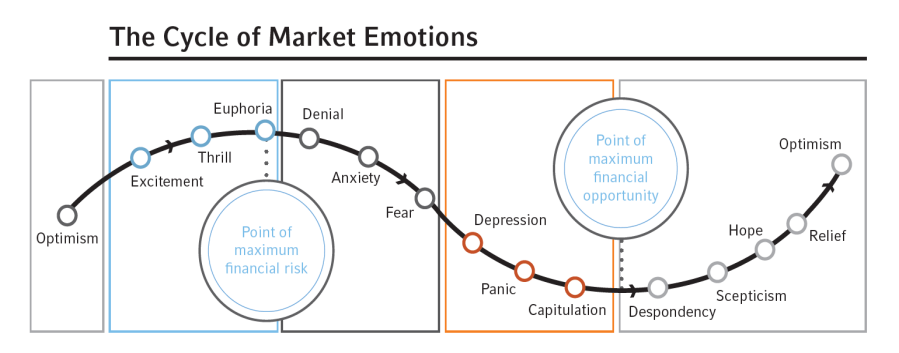

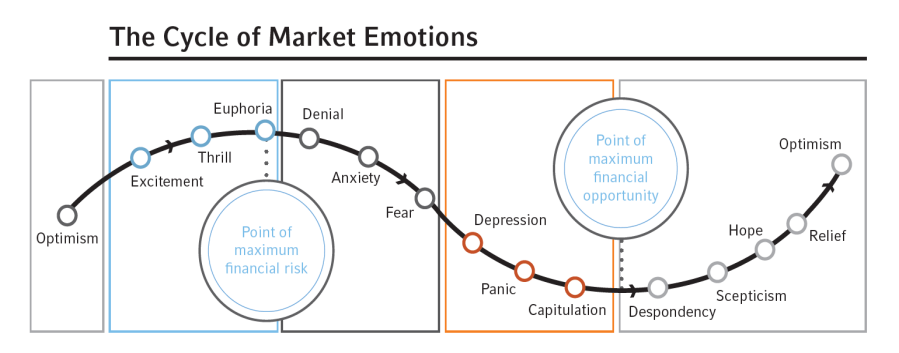

Myopia – Investors tend to use horizons which are over – focused on the short term. Specifically, their tendency to to extrapolate recent events into the future is a particular weakness.

Hindsight – Investors are inclined to remember the occasions when they beat the market, but not their unsuccessful transactions. Winners are attributed to their own skill and expertise, losers to poor advice. Past events always look inevitable after the event.

Loss Aversion – Investors , not unnaturally, hate to lose. They are heavily focused on book cost and will often defer as long as possible the date of realization of a loss. They sell winners too early, hold losers too long. Losses have a greater impact than gains of a similar magnitude.

Excessive Optimism – Investors are inclined to be confident in their own or in analysts forecasts. They often tend to have excessively optimistic expectation of likely future long- term returns.