Savings and Investments

About Your Savings and Investments

If you are planning for a secure financial future it is important to have a regular look at your savings and how you might improve on what is currently a low return on deposits.

‘No two investors are the same’

Depending on your age and your attitude to risk, investments could be of interest to you. If you are interested in improving your financial situation and making your money work harder for you, why not give us a call and get an informed view as to how you might best proceed.

Some of the Investment Fundamentals

Asset Classes

There are the five main types of investment a fund can invest in:

- Cash: money on deposit (e.g. cash in a bank).

- Bonds: loans to companies or governments.

- Property: bricks and mortar, property equities or REITs (Real Estate Investment Trusts).

- Equities: investment in company shares.

- Alternatives: includes commodities e.g. gold, copper, water infrastructure and agriculture.

In terms of volatility, equities are generally considered to be the most volatile type of asset, followed by property. Bonds are generally considered to be less volatile and money market instruments (including cash) are perceived as the least volatile. Cash, bonds, property and equities were considered the main investment areas, however, alternative investments in commodities such as gold, which could be considered non – traditional investments can provide further diversification to your portfolio.

How much risk should I take on?

This depends on your risk preference, your capacity to withstand risk and your financial objectives. You may think you have an innate knowledge of your risk preference, but this can be more scientifically measured by risk preference tools (questionnaires). Your risk capacity depends on your personal and financial circumstances and how much can you afford to lose on your initial investment?

Finally, you need to consider your investment term. What are you hoping to achieve with your fund? Is there a required rate of return needed for this? What is the risk-return trade off? Are you making this decision with your spouse who might have different views to your own?

Here at IPM Draper we are very firmly of the view that short term investment in the pursuit of quick gains is not the recommended approach. We believe a balanced portfolio, with a range of funds tailored to your specific requirements and beliefs, invested over a considerable number of year’s lifespan is the safest path.

Environmental, Social & Governance – ESG

Sustainability risks which are environmental, social, and corporate governance (ESG) management risks are now factors that have to be considered by fund managers in their investment decisions. Long term sustainability is an important factor and ESG investment is now fully enshrined in our legislation as a result of EU legislation. In this regard we review our product provider’s provisions and literature in relation how sustainability is factored into their investment decisions.

We will help you to

- Understand your goals

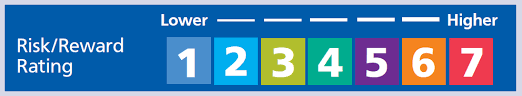

- Develop an Investment Strategy and Understand where you sit on the risk scale. Please see link on how we will identify your risk profile or click on image below

- Understand your Investment Options

- Explain Exit Tax

- And above all we help give you peace of mind